Having a life insurance policy through your employer is a great side benefit.

You get a guaranteed amount of protection with almost no hassle and little relative cost. Unfortunately this tends to lull people into the mindset of “I already have life insurance, so I’m protected” when in reality its just the first step towards protecting yourself and your family.

Getting a life insurance policy is like going to the gym for most people.

Everyone knows that working out is something that should be a part of our daily routine. It helps keep the weight off, reduces stress, and generally makes us feel like we accomplished something. But many times in reality, we didn’t go to the gym that day, didn’t work out long or hard enough, or may have ruined our workout with a pint of Häagen-Dazs later that night. Its easy to procrastinate and delay or only put in a minimal amount of effort for something that could really benefit us.

Life insurance is the same way for a lot of people. Its easy to think that we can put something like buying a life insurance policy off until tomorrow, or that just having life insurance through our employer is enough. We may not even understand that there are living benefits that we can take advantage of. Procrastination can set in and in many cases it may be too late before we can really take action. Buying a life insurance policy depends on taking action early while you are still young and healthy enough to get affordable rates. Doing so can grant you a lifetime of true protection from financial adversity. Having a group life policy through your employer is a great first step, but don’t let in lull you into assuming that its all that you’ll need. In many cases it will not be.

After you sign up for that group life policy through your employer think of a few things:

Is the face value (i.e. death benefit) really enough?

To be blunt – its probably not. Most group life policies issued through an employer have a face value of less than $75,000 and the average is about $50,000. In some cases you are able to add on an additional supplemental policy, but the vast majority of the time these are limited to a maximum of $250,000. It may sound like a lot now, but let’s take a moment to figure out how much your family (or you, remember – living benefits) actually needs.

To get a baseline of how much you’ll need, add up the following:

- Do you have a mortgage? If so – start with the amount you owe for your mortgage.

- Any other outstanding debt (credit cards, car notes, medical..etc)?

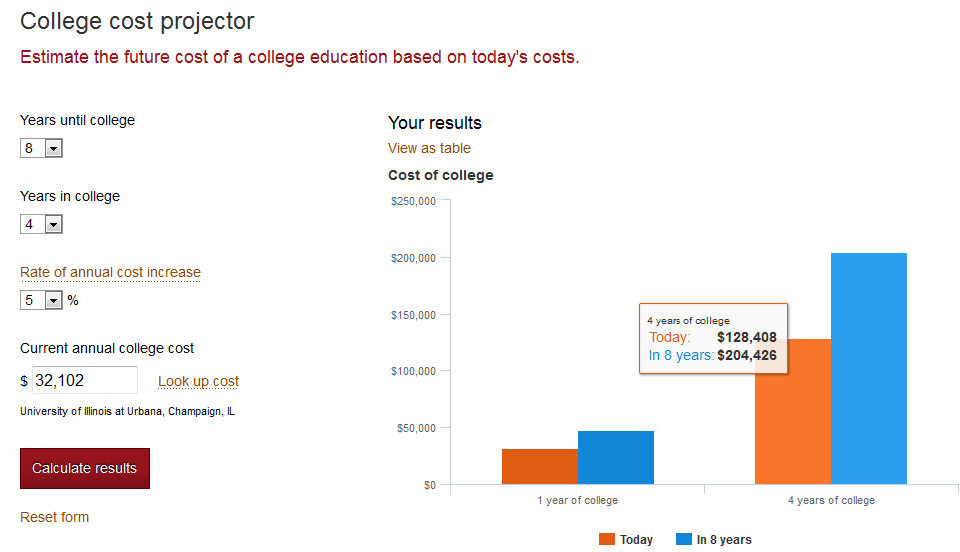

- Do you have children? If you want them to be free of having to worry about the costs of college, then you’ll need to factor those costs in. This calculator does a great job of figuring out what college will cost in the future.

- The amount of years your income needs to be replaced. This can vary, but I usually recommend at least 5 years for couples without children or for those who have teenage children. For those with younger children its best to use 10 years of income replacement. It may sound like a lot, but remember that there is still going to be someone else who has to depend on replacing your lost income just to maintain your family’s current standard of living.

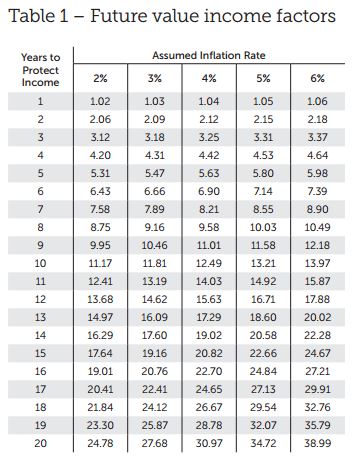

- We also need to take inflation into account. If you have figured out how many years of income you will need to replace, you can use this table to figure out the actual amount you will need to adjust for inflation.

- To figure out the total amount simply multiply your annual income by the income factor in the above chart. Its best to assume a 3% inflation rate. For example, if I have a $100,000 income and want to have 5 years of protection, I will need $547,000 ($100,000 * 5.47).

- We also need to take inflation into account. If you have figured out how many years of income you will need to replace, you can use this table to figure out the actual amount you will need to adjust for inflation.

So let’s walk through a sample scenario.

Let’s pretend I’m a married father of one, making $100,000 year and I have both a $65,000 group life as well as a $100,000 supplemental policy through my employer.

- $200,000 Mortgage Balance

- $10,000 in Credit Card Debt and Car Notes.

- 1 10 Year Old Child – Including Cost of College: $204,426 (seriously – at UIUC):

- 5 years of income replacement at $100,000/year: $547,000.

Total Without College: $757,000

Total With College: $961,426

Total After Employer Policy (Without College): $592,000

Total After Employer Policy (With College): $796,426

So even after my employer policy, I would still need another policy to cover the $592,000 that my family will need even assuming that my child will have to figure out a way to cover their own college costs. See where the danger lies in thinking that you’re totally protected just because you have group life through your employer?

Do I have access to any living benefits?

Don’t think that this is something you’re going to spend money on and never personally reap the benefits from. Life insurance is really about you. Modern policies have a wide variety of benefits that you can take advantage of while you are still living. Many group life polices will have only have an accelerated death benefit that will pay out a certain percentage if you are diagnosed to be terminally ill. That is really the only living benefit you’ll see out of your group life policy. However, an individual policy has many, many more benefits than that including:

- Cash payments for:

- Short & Long Term Disability

- Chronic Illness (i.e. arthritis, Alzheimer’s, Parkinson’s, COPD)

- Critical Illness (i.e. kidney failure, cancer, heart attack, stroke)

- Terminal Illnesses ( non-correctable illness or physical condition which is reasonably expected to result in death within 12 months of diagnosis)

- Long Term Care

- Guaranteed Income For Life During Retirement

- Cash Value Growth

- Orphan Benefits & Scholarships

- Legal Assistance

What happens to my policy if I switch employers?

In most cases you will have a very limited amount of time to convert your employer provided policy into an individual policy. Your rates will go up and you will not have access to any of the supplemental benefits that other individual policies will have.

If you do not convert your policy within that time period you will lose your policy.

Will this protect me throughout my entire life?

Life insurance really is meant for YOUR life, throughout your ENTIRE life! By starting young and purchasing a whole or universal life policy, you will have a lifetime of lasting protection without the increased rates that you would find with a term (group or individual) life policy. Whole and Universal life policies are meant to provide protection for your entire life with a stable premium. Although you can stage term policies to protect you throughout your life, your premiums will go up as you age – they will not with a whole/universal policy. Term polices will also not provide any sort of income during retirement or build a cash value for you to access as a whole/universal policy will. For more information check out our Types of Life Insurance page.

Don’t Procrastinate!

If you find that you need more protection than your employer is currently providing you with reach out to us – TODAY. Don’t procrastinate and let yourself think that you can keep putting this off. It really is going to cost you more as time goes on. Don’t let the size of the face value scare you into thinking that you can’t afford it either. We have a lot of options and can work with almost any budget to make sure that you and your family are protected for years to come.